Introduction

“If you want to walk fast, walk alone. But if you want to walk far, walk together” Respected Ratan Tata.

We live in a world where we witness momentous transformations in the economic structures of the country, consequently mergers and acquisitions have turned out to be a common business instrument which has been adopted and implemented by corporations worldwide. Energised by a philosophy of multiple forces such as shareholders wealth, social and cultural environment, the synergies created through mergers and acquisition have given advantages to companies to grow on a faster level than their competitors.

Nonetheless, in the past some mergers and acquisitions have also failed primarily on the back of factors like finance, marketing and operational issues. In the current globalised markets mergers and acquisitions have become an indispensable component amongst the best business approach and plays a requisite role in the re-establishing and re-organising a business.

Tata Motors acquisition of Jaguar and Land Rover was selected for a number reasons. The automotive industry like many other global industries has undergone extensive transformation over the last decades and primarily through mergers and acquisitions and other alliances as a result of which this industry has provided a information rich context for studies on mergers and acquisitions.

Jaguar and Land Rover are two iconic brands with worldwide recognition whereas on the other hand Tata Motors was a rising contender in the global automotive industry from an emerging country. This union of emerging country and developed country brands received wide media coverage with the prime focus on the potentially disastrous results at the end of this union.

Tata Motors Ltd

Tata Motors Ltd engages in the manufacturing of motor vehicles, it operates through the automotive and other operation segments. The automotive segment operations includes all activities relating to the development, design, manufacture, assembly and sale of vehicles including vehicle financing as well as sale of related parts and accessories. The other operations segment includes information technology services, machine tools and factory automation solutions. The company was founded on 1st September, 1945 and is headquartered in Mumbai, India.

Ford Motor Co

Ford Motor Co engages in the manufacture, distribution and sale of automobiles. It operates through the following three segments automotive, mobility and Ford credit. The automotive segment engages in developing, manufacturing, marketing and servicing of Ford cars and Lincoln vehicles. The mobility segment includes Ford Smart Mobility LLC and autonomous vehicles business.

The Ford Credit segment comprises Ford Credit business on a consolidated basis which is primarily vehicle related financing and leasing activities. The company was founded by Henry Ford on 16th June, 1903 and is headquartered in Dearborn, Michigan.

History of Jaguar and Land Rover

Jaguar and Land Rover are two iconic British brands that were acquired by Ford Motor Corporation in 1989. Land Rover is a British car manufacturer that specialises in four wheel drive vehicles, the name started from a single vehicle that was named by the Rover Company as Land Rover in the year 1948. After, developments this became a porch of a variety of four wheel drive models such as Discovery, Range Rover, Freelander and Defender.

In its history this company has had a number of ownerships. In the year 1967 Leyland Motor corporation absorbed the Rover Company. Leyland then formed a merger with the British Motor Holdings and formed British Leyland. The new company broke up in the year 1980 but in the year 1988 the Land Rover (Rover Group) was purchased by British Aerospace. The Rover Group was acquired by BMW in the year 1994 but the merger broke down in the year 2000 where the Rover Group was taken up by Ford Motor Company. It was in the year 2008 that Land Rover was sold to Tata Motors along with Jaguar.

Jaguar Cars Ltd or Jaguar is a British luxury car manufacturer whose headquarters are located in Coventry UK. In the year 1922 the company was founded as Swallow Sidecar Company that used to make motorcycle sidecars and later passenger cars. After the Second World War, the SS connotations were unfavourable hence the name changed to Jaguar. The name changed to Leyland and eventually British Leyland in the year 1984 when it was listed in the London Stock Exchange.

The Ford Era : Jaguar and Land Rover

Ford Motors decided to expand its product portfolio in from a mass manufacturer of car towards premium car manufacturer and created a new segment known as Premium Automotive Group (PAG) under which Ford acquired three luxurious brands known as Jaguar, Land Rover, Aston Martin and Volvo at a relatively high premium which collectively was called as the Premium Automotive Group (PAG). When Ford acquired Jaguar and Land Rover, it had to compete fiercely with General Motors.

The auto industry analysts believed that Ford had paid significantly more than the brands worth. In 1989, Ford paid US$ 2.5 billion for Jaguar and in 2000 Ford paid US$ 2 .73 billion for Land Rover. In 1987, Ford also purchased a 75% controlling stake in Aston Martin for US$ 32 million and Volvo cars in 1999 for US$ 6.5 billion.

Fords motivation for acquiring Jaguar was primarily driven by the fact that Jaguar was a premium brand which would assist Ford in entering into the luxury segment of the automotive market. However, Ford already had a successful luxury brand in the form of Lincoln but it was primarily positioned at the lower end of the luxury car market. Rather than focusing on creating a new luxury brand, Ford desired a market ready brand that could compete with the Japanese and European firms.

Reason behind Ford selling Jaguar and Land Rover

In 2007, Ford Motor Company the world’s third largest automaker based on vehicle sales worldwide reported the largest annual loss in the history of establishment of the company since the year 1903. The company reported a loss of US$ 12.8 billion. It was also stated by them that they would not return to profitability until 2009. In September 2006 after Allan Mulally assumed charge as the President and CEO of Ford, Allan Mulally decided to dismantle the PAG. In March 2007, Ford sold the Aston Martin Sports car unit for US$ 931 million.

Ford sold jaguar and Land Rover because they were at a significant financial drain on the company. Ford had to sell both Jaguar and Land Rover together because they shared production facilities making their individual disposals would be difficult. The name of the project under which they were sold was code named as “Project Swift” this name clearly signifies Fords eagerness to sell off Jaguar and Land Rover as soon as possible.

Ford paid a significant premium for the ailing Jaguar brand which had a very low annual sales volume and was barely breaking even. Ford Motor Company’s 1990 annual report in which the management admitted that Jaguars US$ 2.5 billion price tag was five times its actual net asset value, to put it in simple terms Ford paid US$ 2 billion for the brand Jaguars goodwill and the rest was paid for the brands other tangible assets. Ford spent over US$ 10 billion in total in next 15 years after acquiring Jaguar to rebuild Jaguars factories and to engineer new models as well as marketing purposes.

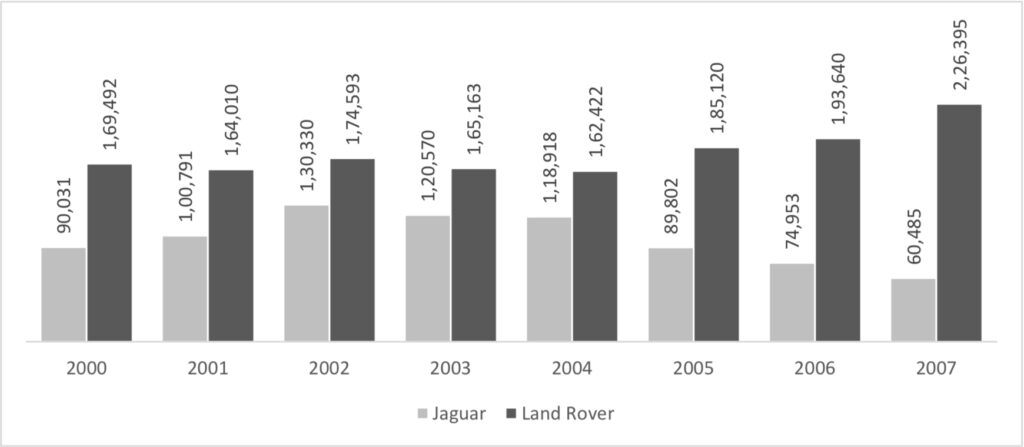

The graph mentioned below represents the sales volume of Jaguar and Land Rover under Ford ownership and it can seen that Land Rover’s sales volume was steadily increasing. Land Rover’s sales volume in 2000 stood at 169,492 units which fell slightly to 164,010 units in 2001 before rising to 174,593 units in 2002. In 2003 sales volume increased to 165,163 units and this trend continued in 2004 with sales volume falling to 162,422 units. However in the three years leading upto the sale of Land Rover to Tata Motors, sales volume increased significantly year on year. The number of units sold increased from 185,120 in 2005 to 193,640 in 2006 and 226,395 in 2007.

Jaguars sales volume in 2000 was 90,031 which increased to 100,791 units in 2001 and 130,330 units in 2002. However, in the years leading upto the sale to Tata Motors, Jaguars annual sales volume plummeted. Sales volume was 120,570 units in 2003 then fell to 118,918 units in 2004, 89,802 units in 2005, 74,953 units in 2006 and 60,485 units in 2007.

The declining financial condition of the firm put pressure on the firm financials due to the decreasing sales volumes. Hence, the management decided to sell off not just Jaguar and Land Rover but also the other luxury brands namely Aston Martin, Volvo with the objective to focus on its flagship brand Ford and to gain the financial stability. As a result of this the management of the company put Jaguar and Land Rover to the assets held for sale category in 2007.

Components related to the sale of Jaguar and Land Rover

First of all, Ford overpaid for Jaguar. According to Fords annual report, the acquisition price of US$ 2.5 billion was five times more than Jaguars actual net asset value, Which the media reports described as a significant premium. Ford executives justified the high price by claiming that they were paying a premium for the Jaguar brand. Jaguar sold only 51,939 units the year before the acquisition and the brand was barely breaking even.

Furthermore, despite Fords significant investment in upgrading the old Jaguar factories there was a lack of new products. It is reasonable to assume that Fords heavy investment in factory improvements limited its ability to invest more in new product development which ultimately hurt its sales.

Lastly, there is no evidence that Ford was able to use its global market coverage to expand Jaguar distribution in order to increase sales. Even though Ford had 10,963 dealers in 2007 for Ford Vehicles, Jaguar had only 859 dealers. As a result, it appears that Ford failed to properly leverage its extensive dealer network in order to expand Jaguars dealer network.

Tata Motors : Jaguar and Land Rover Deal

Tata had the biggest buyout in the automobile space done by an Indian company. On June 2, 2008 this deal bought the ownership of luxury brands namely Jaguar and Land Rover. This deal also included the purchase of JLRs manufacturing plants, two advanced design Centers in the UK, national sales companies spanning across the world and also the licenses of all the necessary Intellectual Property Rights.

Tata Motors was interested in acquiring Jaguar and Land Rover because it would reduce the company’s dependence on the Indian market which accounted for 90% of its sales. Morgan Stanley reported that JLRs acquisition appeared to be negative for Tata Motors as it had increased the earnings volatility given the difficult economic conditions in the key markets of JLR including the Europe and United States.

Tata Motors raised US$ 3billion through bridge loans for 15 months from a clutch of banks, including Citigroup, State Bank of India and JP Morgen. Tata came under cash crisis because of the corus deal and the massive investments made in the Tata Nano project which itself was surrounded in uncertainties. The credit rating companies also took a negative outlook towards this deal because of the huge debt requirement to complete the deal.

Why did Tata Motors go for Jaguar and Land Rover

Tata Motors had several major international acquisitions to its credit. Tata had acquired Tetley, South Korea based Daewoo’s commercial vehicle unit as well as Anglo-Dutch Steel maker Corus. Tata Motors long strategy included consolidating its position in the domestic Indian market and expanding its international footprint by leveraging on in-house capabilities and products as well as through acquisitions and strategic collaborations.

On acquiring JLR, Chairman of Tata group, Ratan Tata, said “We are very pleased at the prospect of Jaguar and Land Rover being a significant part of our automotive business. We have enormous respect for the two brands and will endeavour to preserve and build on their heritage and competitiveness, keeping their identities intact. We aim to support their growth, while holding true to our principles of allowing the management and employees to bring their experience and expertise to bear on the growth of the business.”

Tata Motors stood to gain on several fronts from the deal. One, the acquisition would help the company acquire a global footprint and enter the high end premier segment of the global automobile market. After acquisition, Tata Motors would own the world’s cheapest car the US$ 2,500 Nano and luxury marquees like the Jaguar and Land Rover.

Second, Tata Motors also got two advance design studios and technology as a part of the deal. This would provide Tata Motors access to the latest technology which would also allow Tata to improve their core products in India such as Safari and Indica which suffered from internal noise and vibration issues.

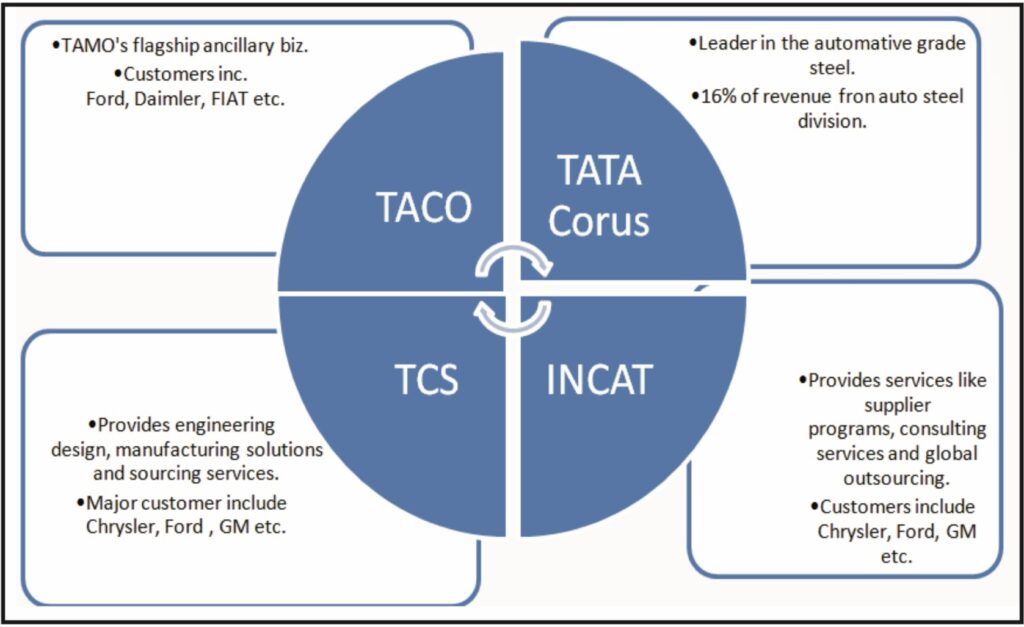

Third, This deal provided Tata an instant recognition and credibility across the globe which would otherwise might have taken years. Fourth, the cost competitive advantage as corus was the main supplier of automotive high grade steel to JLR and other automobile industry in Europe and US. This would have provided a synergy for Tata Group on a whole. TCS for providing engineering design, manufacturing solutions and sourcing services. INCAT provides services like supplier programs, consulting services and global outsourcing. The whole cost synergy that can be created can be seen in the following diagram.

Five, in the long run Tata Motors will surely diversify its present dependence on Indian markets along with it due to Tata’s footprints in South East Asia it will help JLR do diversify its geographic dependence from US and Western Europe. Analysts were of the opinion that the acquisition of JLR which had a global presence and a repertoire of well established brands would significantly help Tata Motors become one of the major players in the global automobile industry.

Price paid by Tata Motors for Jaguar and Land Rover Acquisition

Tata Motors paid US$ 2.3 billion in cash for the two iconic brands Jaguar and Land Rover. Tata Motors paid higher than the market expected but it was certainly still less than half of what Ford originally paid. In 1989 and 2000, Ford had paid US$ 2.5 billion for Jaguar and US$ 2.73 billion for Land Rover. Ford also paid US$ 600 million for the pension plan for a total acquisition cost of US$ 5.8 billion.

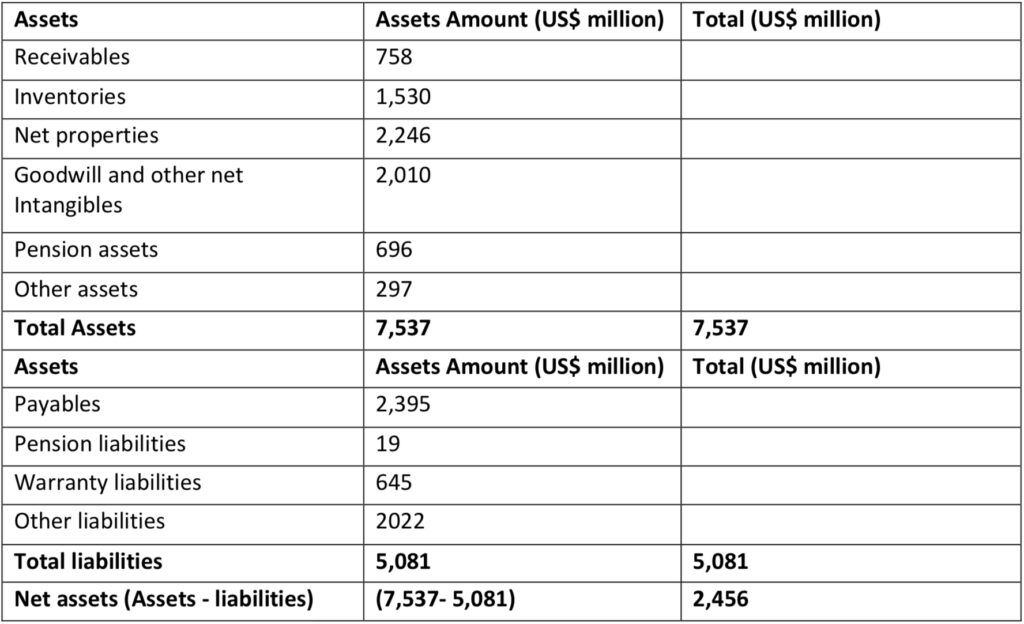

In the opinion of industry analysts, Tata got these two brands at a bargain price. Total assets of Jaguar and Land Rover stood at US$ 7.54 billion while total liabilities stood at US$ 5.08 billion at the time of acquisition. The book value of net assets (difference between assets and liabilities) stood at US$ 2.46 billion at the time of acquisition of the US$ 7.54 billion of total assets. Ford Motors estimated the value of the two brands at US$ 1.09 billion.

Tata paid a price of US$ 2.3 billion that was less than the book value of these two brands assets US$ 2.46 billion. Whereas Ford paid US$ 2.5 billion for just the Jaguar brand, Tata paid only US$ 2.3 billion for both Jaguar and Land Rover. As a result, some industry experts referred to this transaction as a “BOGO” Buy one, Get one free transaction.

Assets and Liabilities of Jaguar and Land Rover at the time of Acquisition

How Tata revived Jaguar and Land Rover

Tata Motors success in reviving JLR is applaudable, given how quickly the two brands particularly Jaguar began to turn a profit under Tata Motors. Where previous owners BMW and Ford Motors failed. Tata Motors success with these two iconic brands is admirable. The time when Tata had purchased JLR in march 2008 just months before the global credit crunch, Jaguars future appeared doomed and the financial crisis made things even more difficult.

Tata Motors spent US$ 1 billion in the first year after acquisition to keep the brands afloat. When cash was scarce, Tata Motors hired Roland Berger and KPMG strategy consultants, a German based consultancy firm to advice on cost cutting, cash flow management, lowering breakeven volumes and increasing the overall efficiency JLRs operations.

Difficult Road for Tata Motors

The product at JLR was stagnant and Tata Motors was beginning to feel overburdened. The UK government considering a bailout of JLR and Tata Motors market value plummeted to INR 6,503.2 Cr which is US$ 1.28 billion with the stock reaching a low of INR 126.45 on 20th November 2008. Its market capitalisation was less than what it paid for JLR from Ford. Tata Motors reported its first annual loss in at leat seven years after luxury unit sales fell amid the global downturn. The consolidated net loss was INR 2,500 Cr which is US$ 480 million in the fiscal year ended 31 March 2009, compared to a profit of INR 2,200 Cr which is US$ 551 million the previous year.

Cash was still of priority as JLR was losing money so the company sought outside assistance. Tata Motors turned to consultants KPMG because JLR did not have its own cash management system. According to Forster, for the next few months “cash started to be managed on an hour to hour basis what cheque was going out and what cheque was coming in”. In the spring of 2009 Munich based Roland Berger strategy consultants was brought in to keep costs under control. Roland Berger was given a simple task which was to make JLR profitable.

Cash Management Plan

Wolfgang Bernhart stated that “a three tier model was developed”. Wolfgang Bernhart was a partner at Roland Bergers Automotive Competence Centre. One, a short term goal of managing liquidity was established with the assistance of KPMG. Wolfgang Bernhart then mentioned a mid-term goal of cost containment at various levels as well as the formation of 10-11 cross functional teams.

A number of management changes were implemented including the appointment of new executives at JLR. Lastly, a long term goal was developed that will last until 2014, focusing on new models and refreshing existing one. The main goals are cash management and cost control.

For the product development huge cash was required and to aid that the management of Tata Motors embarks a plan to sell stakes in group companies to raise money. They sold a 1.3% stake in Tata Steel Ltd to holding company Tata Sons Ltd in September 2008 for a total of INR 485 Cr which is US$ 103 million. In addition, the board also approved rights offer for INR 4,147 Cr which is US$ 810 million in November 2008.

The prime objective to make JLR profitable all proceeds were invested in Tata Motors. Importantly, Tata Motors was able to maintain product development plans which resulted in the global economy reviving and customers returning to the JLR showrooms.

Tata Motors Turnaround

Sales were up due to the introduction of newer more fuel efficient and contemporary models as well as a revival of demand in the companies key markets such as the US, UK and Europe. JLR model deliveries to dealers worldwide increased to 115,508 units in the six months to September from 80,252 the previous year. The new jaguar XJ was especially popular with 8,700 units sold since the models release in mid of May.

JLR accounting for more than half of Tata Motors business the company posted a 100 fold jump in profit in the three months to 30 September. The debt to equity ratio is down to 1.6 times at the consolidated level from 4.5 times at the end of 31 September 2009. That was high buy comfortable given surging volumes. The share had risen to a respectable INR 1,302.15 at close on 10 November on the Bombay Stock Exchange taking the market capitalisation to INR 79,573.08 Cr which is US$ 18 billion.

Tata Motors decision was influenced by a number of factors. Despite Jaguars mixed reputation both were fantastic brands. Ford had spent a lot of money to improve the quality and it was only a matter of time before it showed. JLR had excellent automobile plants. Despite losses over the previous four to five years the dealers remained steadfast.

Was this deal a loss or profit for Tata Motors

Morgan Stanley reported that JLRs acquisition appeared negative for Tata Motors as it had increased the earrings volatility given the difficult economic conditions in the key markets of JLR including the US and Europe. Tata Motors had to incur a huge capital expenditure as it planned to invest another US$ 1 billion in JLR. This was in addition to the US$ 2.3 billion it had spent on the acquisition. Tata Motors had also incurred huge capital expenditure on the development and launch of the small car Nano and on a joint venture with Fiat to manufacture some of the company’s vehicles in India and Thailand. This coupled with the downturn in the global automobile industry was expected to impact the profitability of the company in the near future.

The worldwide car sales were down 5% as compared to the previous year and the automobile industry the world over is rationalising production facilities, reducing costs wherever possible consolidating brands and dropping model lines and deferring R&D projects to conserve funds. The Chinese and Indian domestic markets for cars have been exceptions. whilst China has witnessed a significant reduction in its automotive related exports and supplies to automobile companies, the Chinese domestic car market has grown by 7% in India the passenger car market has remained more or less flat compared to the previous year.

Since then, its fortunes have been unsure as the slump in demand for automobiles has depressed its revenue at the same time Tata had invested nearly US$ 400 million in the Nano launch and struggled to pay off the expensive US$ 3 billion loans it racked up for the Jaguar and Land Rover shopping bill. Within the space of a year, Tata Motors had gone from being a developing world success story to a cautionary tale of bad timing and overly ambitious expansion plans.

Tata Motors standalone Indian operations profits declined by 51% in 2008-2009 over the previous year. All through the fiscal year ended March 2009 the company bled money, losing a record US$ 517 million on US$ 14.7 billion in revenues, just on its India operations. Jaguar and Land Rover lost an additional US$ 510 million in the 10 months Tata owned it until March 2009.

In January 2009, Tata Motors announced that due to lack of funds it may be forced to roll over a part of the US$ 3 billion bridge loan after having repaid around US$ 1 billion. The financial burden on Tata Motors was expected to increase further with the pension liability of JLR coming up for evaluation in April 2009.

Drawback of not going for this Acquisition

There was immense pressure from the shareholders and analysts community etc. to abort the deal as they unanimously agreed that it was over priced and the balance sheet of Tata was not in a position to absorb more loan. Ford purchased JLR at US$ 5 billion and sold at almost half the price to Tata after operating it for losses for few years.

As the market would have recovered from recession the valuation would have increased since there would have been growth in the demand of JLR thus creating more problems for TAMO. Tata would not have been able to enter into the premium segment in India. TAMO would have lacked in robust designing capabilities. Above all, at that time no other major automobile brand was available for acquisition with such designing and R&D capabilities.

Current Situation

2019 – 2020

Initially JLR has performed strongly after the merger and was slowly and steadily repaying Tatas immense faith in its name and reputation. On June 15, 2020 JLR reported a drop in its sale figure for fourth quarter and financial year ended March 31st, 2020 due to Covid-19 pandemic. The luxury carmaker said the pandemic “significantly impacted” its projections for 2019-2020 with fourth quarter retail sales down 30.9 per cent and full year sale lower 12.1 percent. Since the year 2014-2015 JLR is facing problems and its sales is reducing throughout the globe.

Tata Motors suffered consolidated fourth quarter net loss of 98.94 billion rupees as Covid-19 lockdown across its markets weakened sales, including at JLR. Its total sale of passenger vehicles for financial year 2019-2020 is 38% less than financial year 2018-2019 and total sales of commercial vehicles is 34% less in comparison to financial year 2018-2019. Tata Motors losses mount with sluggish sales in China and Brexit adding to its woes.

Tata Motors was reviewing all its, revising its investments and working capital and the company had also launched inventory correction programme. During the time of Covid-19 the company laid off 1,100 employees as it was focusing on cost cutting JLR deal was not proving to be very good for the company in the year 2020. JLR is like a two edged sword for Tata Motors, if JLR performs well Tata Motors earns its profit near to 80% from JLR and When JLR does not perform well in that situation most of the losses of Tata Motors is from JLR.

In the past, the company has launched few vehicles but they did not perform well. Due to which Tata Motors survival was getting difficult. The company was struggling for profits in the last few years, in fact the company suffered huge losses of 28,826 Cr in 2019. Apart from losses, the company had taken a huge debt nearing to one lakh crore. The situation of the company was quite delicate in the year 2020.

7 July 2023

JLR reported increased sales for the first quarter of FY24 (three month period to 30 June 2023) compared to a year ago reflecting continuing improvement in chip and other supply constraints. Wholesale volumes for the first quarter were 93,253 units (excluding the Chery Jaguar Land Rover China JV) up 30% compared to the same quarter a year ago. Wholesales were slightly lower (down 1%) compared to the prior quarter ending 31 March 2023 reflecting shipping schedules while production was up quarter on quarter.

Retail sales for the first quarter were 101,994 unit (including the Chery Jaguar Land Rover China JV), up 29% compared to the same quarter a year ago. Retails were broadly flat (down 1%) compared to the prior quarter ending 31 March 2023. Compared to the prior year, retail volumes were higher in the overseas (83%), North America (up 42%), China (Up 40%) and UK (Up 6%) regions while flat in Europe (0%). By model, retail sales of our three most profitable models were up significantly compared to the same quarter a year ago with Range Rover up 199%, Range Rover Sport up 42% and Defender up 90%.

The order book remained strong with over 185,000 client orders at quarter end, reducing from 200,000 at 31 March 2023 in line with expectations, as chip and other supply constraints continue to improve. Range Rover, Range Rover Sport and Defender demand remains particularly strong representing 76% of the order book.

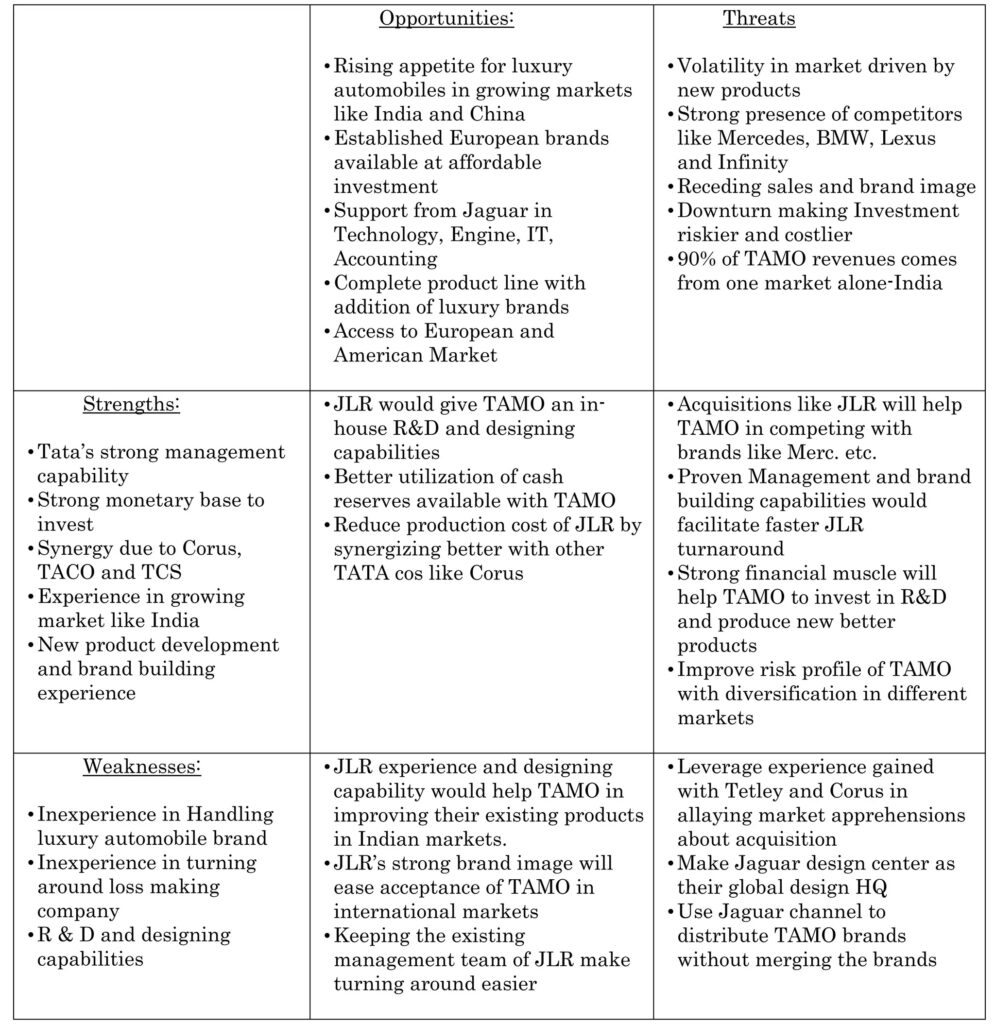

The TOWS Matrix

Threats, Opportunities, Weaknesses and Strengths

Advantages for Tata Motors

Tata Motors Ltd had a great advantage of having access to the technology and expertise potentially available in JLR. This would enable Tata Motors to make improvisations in their lower end cars without much expenses as the designing and innovation available in both the companies would be integrated which would incredibly boost the quality of products. This eventually is a result of operating synergy. This leads Tata to widen the market not only based on geographic location but also based on segments of cars. The acquisition also helped Tata to have a wide portfolio of cars by broadening the utility vehicles and sports utility vehicle segment.

The acquisition of JLR also helps Tata to enter the segment of luxury cars as Tata is mainly focused on cheaper or lower end cars whereas JLR mainly produces and sells luxury or higher end cars. Moreover, this segment of cars is widely demanded and attractive all over the world. One of the main forces for the acquisition is the workforce that Jaguar has. It comprises of 16,000 men working in design studio, vehicle development, power train integration and many more which will provide both operating and financial synergy to the integrated companies.

There is also financial synergy to Jaguar as Tata Consultancy Services would help them acquire raw materials at a cheaper price. The sales market for Tata Motors can be incredibly increased using the distribution network of JLR and not relying majorly on the Indian market.

Disadvantages for Tata Motors

The increase in the interest rates during the time of acquisition made it more costly for Tata for the acquisition as the borrowing costs went high. To add fuel to the fire even the fuel prices were increasing at that time, making the demand go down. This eventually sets back Tata with higher acquisition cost and increased time for breakeven.

The above factors have left Tata Motors with a negative capital and interest coverage. There was also liquidity issues faced by Tata which states that paying off the loan was problematic for Tata. Tata then turned to the equity market to raise funds as the debt market was frozen at that time due to Global Financial Crisis. Even the share prices of Tata Motors dropped significantly as the net profit and earnings per share decreased after acquiring JLR. The share prices eventually then recouped after the posting of profit by JLR.

Conclusion

Tata Motors decision of the acquisition can be criticised on the ground of time of dealing that is changing the economic situation in the global market and a serious downfall of global economy. Post acquisition due to slowdown in the domestic and world market the demand of commercial as well as the passenger vehicle was also decreased and Tata Motors was the victim of that. One of the major revenue streams for Tata Motors was commercial vehicle before this fascinating acquisition and the top management thought process towards this acquisition was to develop its brand value and equity separately in the luxury or premium car segment in the global market but it went in vain.

The overall opportunity came to Tata Motors for the acquisition was also the part of economic downtrend and the top management fail to understand the consequences of the decision. What are the strong areas for Tata Motors was their managerial competencies along with their experience in a large market like India and their goodwill. A great brand value and financial base actually help them to take such important strategic decisions to go ahead in the global market despite of a serious fall in domestic market demand.

Tata Motors is trying to develop its brand value and equity in the global market with the help of some other acquisition strategies to grow further and they try to make sure that there should not be any further issues in financial front.

Read more